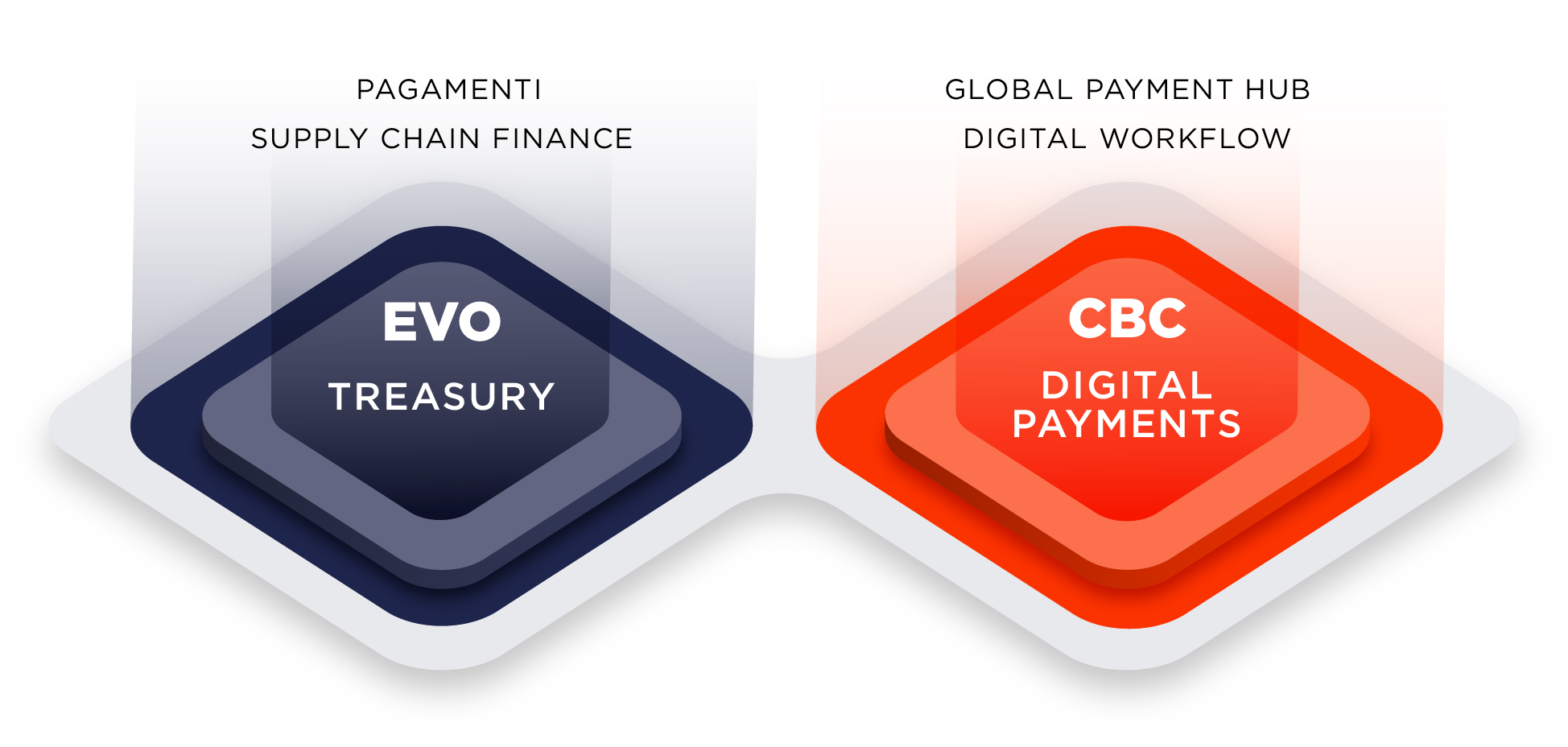

The continuous search for operating efficiency makes Piteco‘s Digital Payments solution the most comprehensive Treasury option for companies striving to optimise their company payments area by activating the dedicated functions and implementing the best practices of Piteco.

Company payments and Payment Factory

When ordering payments, the Finance and Treasury department needs to have the possibility of selecting which banking intermediaries to use in light of credit lines, current and outlook available funds and the cost of obtaining financial resources.

Piteco solutions supporting Digital Payments enable companies to control and order any type of payment: bulk, manual, advance, wages, bill payments, tax authorities, reimbursements, etc., or all payment orders that can be authorised by enabled users and that the Treasury can finalise by integrating Fintech Solutions already available within the Piteco Supply Chain area with the traditional banking channel.

Global Banking Connectivity

Piteco plays a banking connectivity hub that normalizes and manages various international bank formats enabling companies to transmit payments or receive bank statements at national and global level in a safe, efficient and increasingly fluid way.

Authorisation Workflows

To supplement and complement its functions dedicated to the management of Payment Processes, Piteco offers the Corporate Banking Communication solution: the payment authorisation and ordering platform on which users securely log in, apply the individual authorisation workflow (power of signature) defined with the individual banks and digitally sign each payment order.

Security

The CBC platform manages multiple usage combinations in complete security: mobile management of payment authorisations, tracking of individual transactions executed by representatives, authentication procedures to check the identity of enabled representatives (Strong Customer Authentication) and the definition of the optimal architecture to guarantee excellent security levels for every payment order, including with Digital Signatures.

Virtual Payments

Piteco works every day to optimise increasingly efficient Digital Payments methods and tools, improving efficiency on one hand and the customer experience on the other. One example of this is the innovative supplier payment solution based on virtual credit cards. This tool can be used to pay suppliers on time using an additional spending limit, deferring the payment’s impact on Cash Flows.

Currency accounts

Piteco offers its corporate customers a single Platform integrating services for ordering international payments in 140 currencies with the Digital Payments service – without having to manage specific currency accounts – thus accelerating and automating the supplier payment process. Aside from complete transaction security and the full automation of payment processes, the Platform significantly reduces transaction costs and provides full transparency with respect to the fees and exchange rates applied.