Keeping fit for growth in financial software

24 febbraio 2020

Despite its position as Italy’s leading software house for corporate treasury management and financial planning, Piteco S.p.A. is still setting itself challenging goals; one of the most important is continued growth. Founded in 1980, the company has already seen extensive change in the market, and is striving to remain at the forefront of future developments.

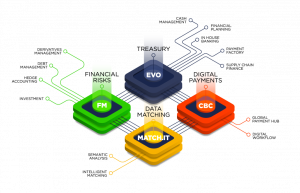

Piteco specializes in the design, development and implementation of administration, finance and control software for general industry as well as the banking and finance sector. Central to its product portfolio is EVO (Piteco Evolution), the company’s best-selling solution which covers finance processes across the board.

“We work with clients in diverse industries, which has helped us to develop a product which meets all the requirements of treasury and financial planning, and also offers features specific to particular functions such as digital payments,” explains Co-Founder and CEO Paolo Virenti.

CBC (Corporate Banking Communication), designed specifically to dematerialize, simplify and track company payment authorization processes, is a digital payment solution for the governance of authorization workflow, and the transmission of payment orders to the national and international banking system. For treasury and credit managers who need reliable analysis, matching and reconciliation of data, Piteco’s sophisticated MATCH.IT software is the perfect tool. The fourth instrument, FM (Finance Modelling for Financial Risk Management) integrates operations across the back, middle and front offices. “We invest heavily in fintech and financial planning solutions, and are planning to launch a new version of EVO later this year,” reveals Mr. Virenti.

Over the firm’s 40-year history, the management team has constantly striven for growth through new products and acquisitions. In the 1990s, the company developed Piteco 2000 – unique at that time – which was designed to support the integration of the SAP systems which were being widely implemented across Europe; further innovative software tools followed. 2015 saw the start of an acquisition strategy with the purchase of a large storehouse a branch of an Italian company supplying it services; the company entered the US market in 2017, taking control of Juniper Payments LLC in Kansas, and in 2018 it became the majority shareholder of Myrios, whose high-value products complemented Piteco’s own portfolio.

Read the complete interview on European Business: https://www.european-business.com/piteco-spa/portrait/